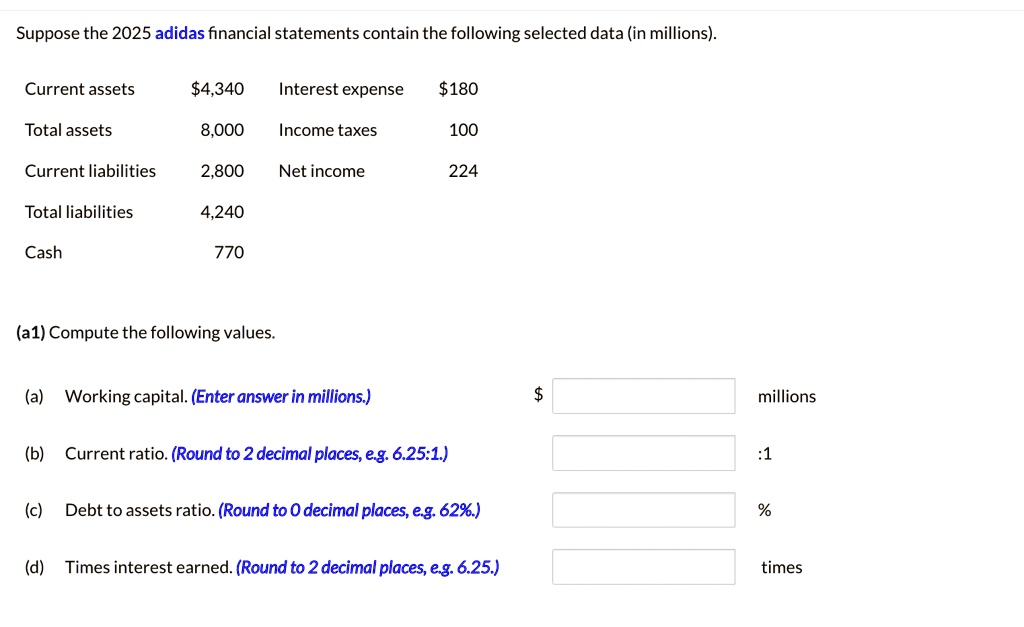

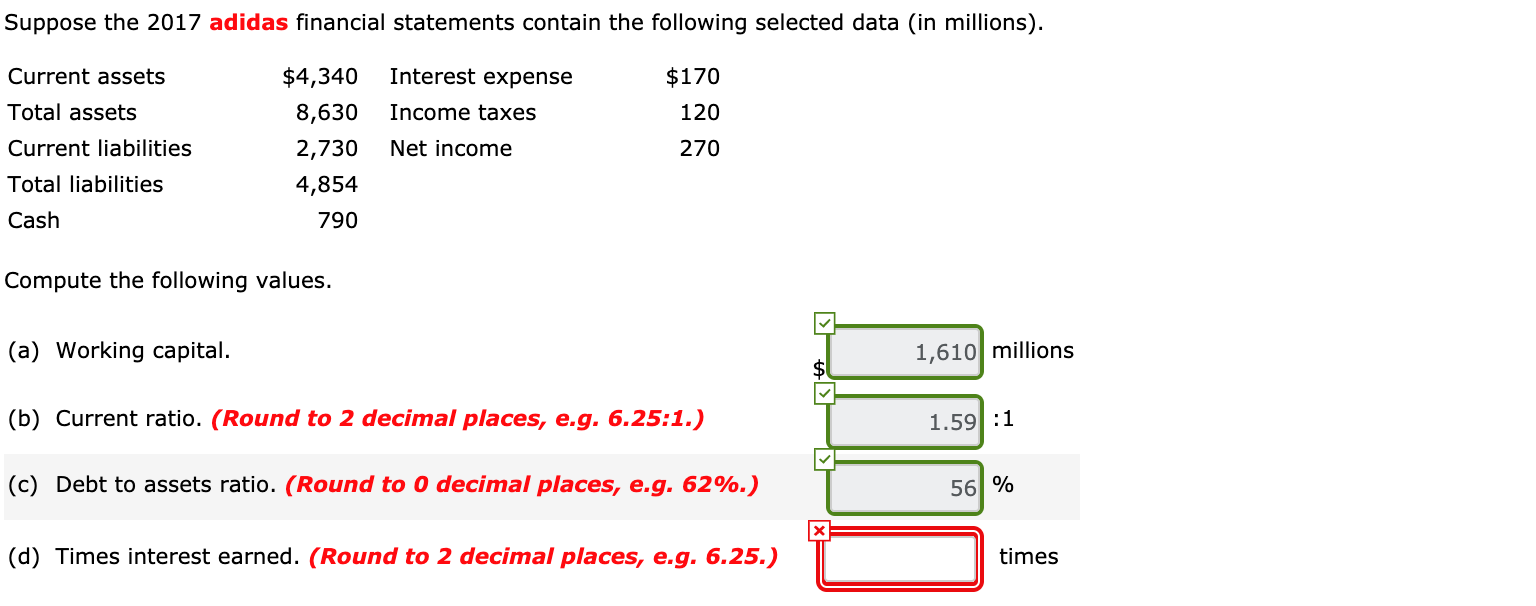

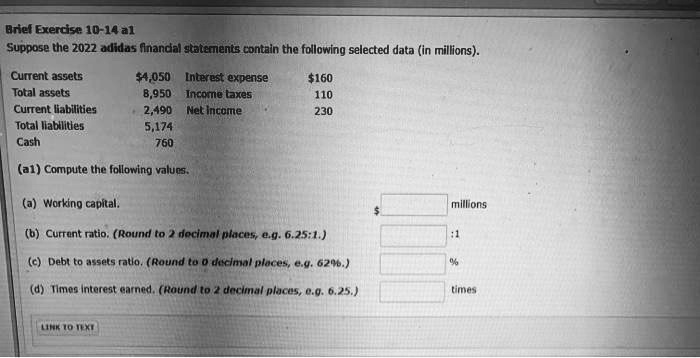

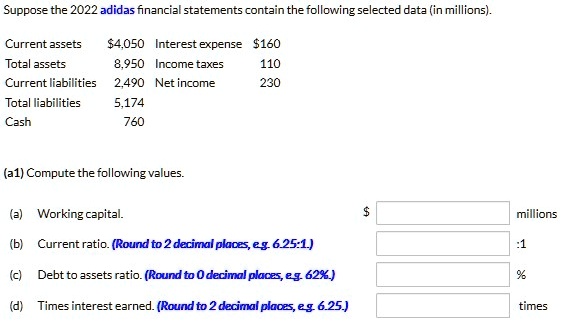

SOLVED: Briel Exercise 10-14 al Suppose the 2022 adidas financial statements contain the following selected data in millions. Current assets Total assets Current liabilities Total liabillities Cash 4,050 Interest expense 8.950 Income

SOLVED: Suppose the 2022 adidas financial statements contain the following selected data (in millions). Current assets 4,050 Interestexpense160 Total assets 8,950 Income taxes 110 Current liabilities 2,490 Net income 230 Total liabilities

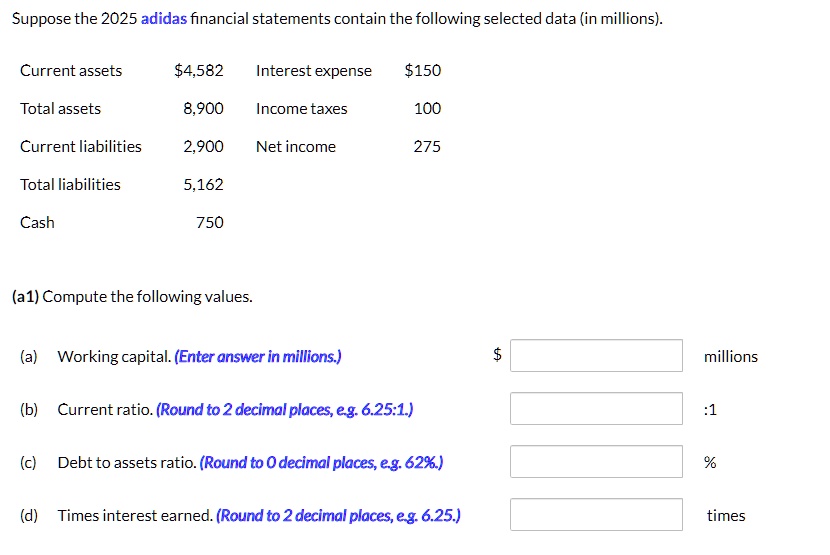

SOLVED: Suppose the 2025 adidas financial statements contain the following selected data (in millions) Current assets 4,582 Interest expense150 Total assets 8,900 Income taxes 100 Currentliabilities 2,900 Net income 275 Total liabilities

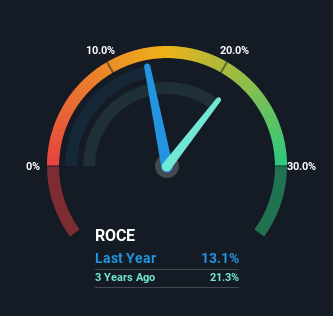

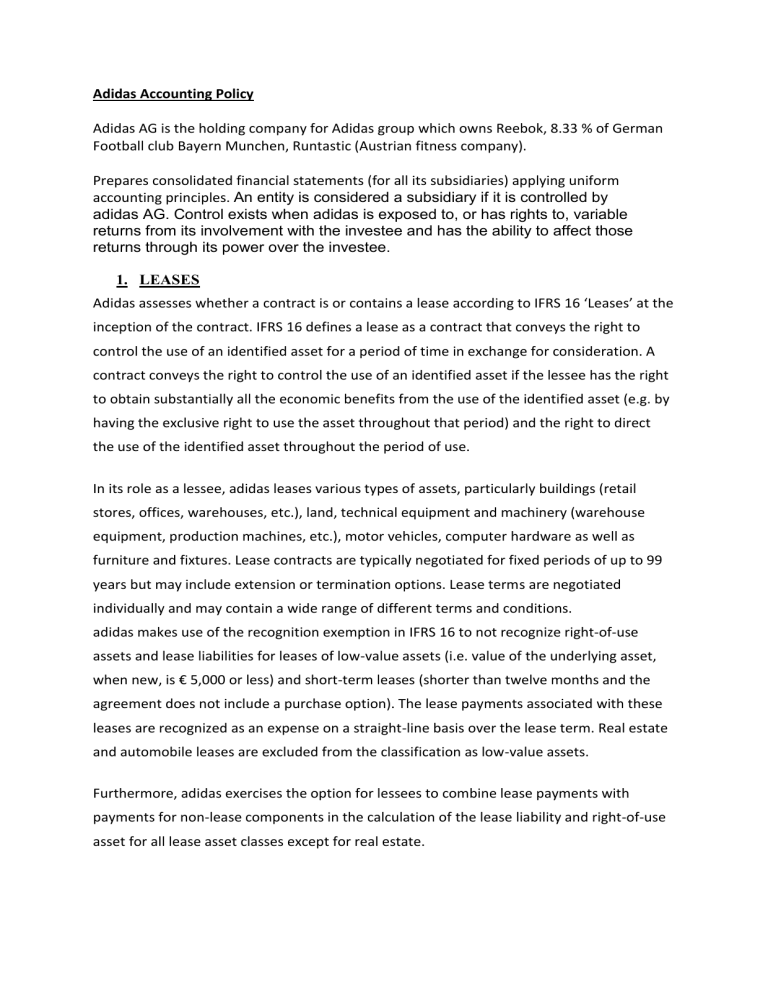

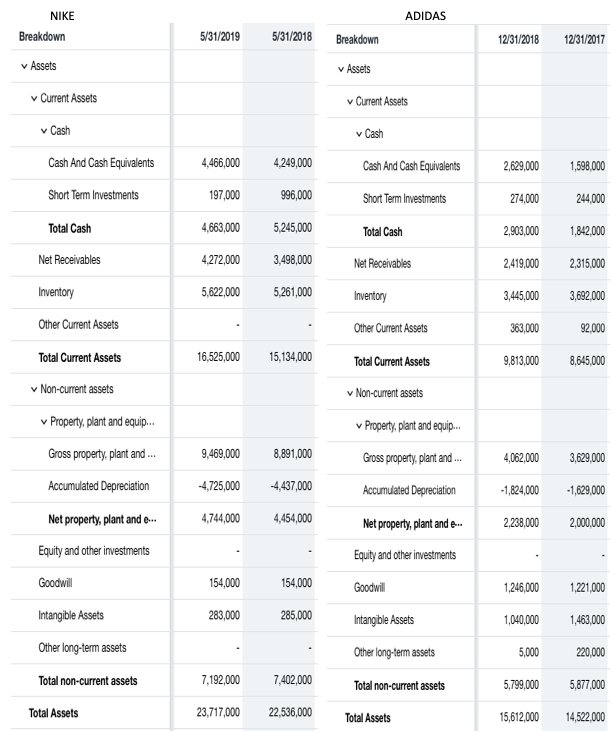

Nike vs Adidas: Where to Invest?. Nike and Adidas are both known brands… | by Kathleen Lara | Medium